On the hypothesis of taxing sugary drinks – long adopted in various countries around the planet, with success in terms of reducing consumption of HFSS foods (1) – the WHO is advancing while Italy is holding back. As is routine, serving the big lobbies.

Italian Minister for Agriculture, Food and Forestry Maurizio Martina has just foiled an attempt by his Finance Colleague Pier Carlo Padoan. Who had hypothesized increasing tax revenues by introducing a tax on the consumption of sugary carbonated soft drinks.

The imposition of additional taxes on the consumption of certain foods appears frequently in the Italian government’s tax maneuvers. The encumbrances on alcoholic beverages in particular, starting with beers, recur frequently. (2) In addition to periodic increases on VAT (3), which in defiance of the principle of progressivity of the tax levy instead affect the generality of consumers, regardless of their incomes.

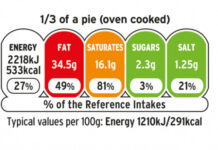

However, the taxation of sugary drinks and carbonated soft drinks finds meaning in the need to discourage the consumption of such products. Water-tap, that is, natural mineral, even carbonated-is definitely preferred. To avoid the intake of simple sugars that is often (outside of those who need ‘glycemic refills,’ during strenuous sports activities for example) unnecessary.

Taxation of sugary drinks, the Mexican lesson

Mexico, first in per capita consumption of ‘soft-drinks,’ (4) already in 2014 implemented a tax that immediately proved effective. Resulting in reduced sales, (5) which is inevitably matched by increased water consumption. It was followed by several cities in the U.S.-the second largest‘soda‘ consuming country-starting with Berkeley and Philadelphia. (6) Then Chile and various tropical countries, (7) most recently Saudi Arabia as well. Debates are proceeding everywhere, from Russia to India, Canada and Ecuador, South-Africa. Just look at the ‘Coke-Leaks‘ for an overview.

A scientific study published in ‘Plos Medicine’ (8) indicates that taxation of sugary drinks introduced by Mexico ‘could prevent 189,300 new cases of type 2 diabetes, 20,400 strokes and heart attacks, 18,900 deaths among adults aged 35 to 94’ over ten years. With significant savings for public health, since ‘reductions in diabetes alone could produce savings in projected health care costs of US$983 million.’

In Europe, Denmark began taxing soft drinks last century, in 1930. In the present day, the levy on‘soft drinks‘ was introduced in Finland and Hungary in 2011, in France the following year. This was followed by the United Kingdom and Ireland (2016, effective 2018), Norway and Catalonia (2017). (9) Spain and Portugal meanwhile discuss what to do.

WHO recommendations

The battle against obesity, overweight and related diseases–type 2 diabetes, cardiovascular disease, cancer–remains arduous, for a wide range of reasons. Among these, Big Food ‘s responsibility for scriptedmarketing of HFSS foods and reluctance to improve their nutritional profiles should be noted.

Some doubt that a handful of‘cents‘ difference on the price of a can is enough to induce change. Yet, the taxation of sugary drinks in different countries is working. And so-without subtracting merit from the public awareness campaigns that accompany the new taxes-it is the pennies that move the needle on the scale. Especially considering that none of those countries has succeeded in imposing appropriate bans on advertising to minors of sugars and bubbles.

‘Consumption of simple sugars, including products such as sugary drinks, is a major factor in the global growth of obesity and diabetes. Governments that tax products such as sugary drinks can reduce disease and save lives. They can also reduce health care costs and increase revenue to invest in health services.” (Dr. Douglas Bettcher, director of WHO’s Department of Noncommunicable Disease Prevention)

More measures are needed

Further measures are needed in any case, in addition to the taxation of sugary drinks. First, the continuous availability of water (potable and/or mineral) must be ensured in every context of beverage sales and serving. In vending machines as well as in sports centers, cinemas and entertainment venues, water should never be lacking. And its cost must always be, by law, at least 25-30% less than that of any other soft drink. Consideration should also be given to introducing not only a ‘soda tax‘ but also a ‘sugar tax‘. Taking into account the need to reduce consumption of simple sugars, which to date far exceeds WHO recommended thresholds and contributes to the rampant epidemic of obesity and overweight.

The UN General Assembly, after all, proclaimed the 2016-2025 Decade of UN Action on Nutrition. (10) Which involves a comprehensive effort–by all member states to set, monitor and implement policy commitments to end all forms of malnutrition.

But in Italy, an opportunity (10) that could have been usefully framed in this context – using the proceeds of the‘soda tax‘ for other useful initiatives to encourage balanced diets, starting with the youngest – has been lost.‘Big Soda‘ thanks Minister Maurizio Martina. (12) À la prochaine fois…

Notes

(1) High Sugars, Fats and Sodium, so calledjunk-food. Or ‘of indulgence’(comfort food), in the perspective of‘Big Food‘ and‘Big Soda‘

(2) Moreover, the taxation of alcoholic beverages in Italy has inexplicable peculiarities. Such as imposing excise taxes on beer not on the basis of alcohol content but on the Plato degree, that is, the amount of ‘dry matter’ that expresses the quality of the drink. Thus penalizing Italian beer compared to those brewed in other EU countries

(3) Value Added Tax

(4) The category of sugar-sweetened (including carbonated) beverages includes iced tea,‘energy drinks‘ and‘sports drinks‘. Fruit juices are of less concern because of their natural fiber, vitamin and mineral content. And of their peculiar characteristics (which do not lend themselves to immoderate consumption)

(5) The taxation of sugar-sweetened beverages in Mexico resulted in a significant drop in their sales already in the few months that followed. See http://www.who.int/bulletin/volumes/94/4/16-020416/en/. See also the studies published in BMJ (‘British Medical Journal‘) http://www.bmj.com/content/352/bmj.h6704 and in‘Health Affairs‘ http://m.content.healthaffairs.org/content/36/3/564

(6) Next come Oakland, San Francisco and Albany (California), Boulder (Colorado), Cook County (Illinois), Seattle (Washington)

(7) Where the Bel Paese does not reach has come French Polynesia, Mauritius, Barbados, Dominican Republic, Fiji, Nauru, St. Helena, Tonga (!)

(8) See http://journals.plos.org/plosmedicine/article?id=info:doi/10.1371/journal.pmed.1002158

(9) Cf. http://www.iustel.com/diario_del_derecho/noticia.asp

(10) UN Decade of Action on Nutrition. Regarding specifically the need to reduce sugar in beverages, see http://www.who.int/mediacentre/news/releases/2016/curtail-sugary-drinks/en/

(11) As Dr. Sandro Demaio of WHO recently pointed out, widespread policy action is urgently needed. Sugar-sweetened beverages must be attributed their actual social cost, which still falls on public health (in addition to individual health). An underestimated, often ignored cost that tends to ripple through the decades to follow. At the 15th‘World Congress on Public Health‘, Melbourne, 3-7.4.17

(12) Not as grateful will be the growing community of diabetics in Italy, which is estimated to reach 5 million individuals by 2030

Dario Dongo, lawyer and journalist, PhD in international food law, founder of WIISE (FARE - GIFT - Food Times) and Égalité.