The saga of venture capital ‘offered’ by Inalpi SpA to its suppliers, including in compensation for their receivables on fresh milk sales, is being enriched by intimidation. Also towards us, for reporting the public budget figures of In.Al.Pi. S.p.A. and the settlement of the unsecured bond issue. As well as for expressing some doubts about it (1,2).

The information offered by GIFT(Great Italian Food Trade) seems to have helped open the eyes of Piedmontese farmers to the matter at hand. So much so that one of Inalpi’s two suppliers, Piedmont Milk Cooperative, decided not to underwrite its bond. The other supplier, Compral Latte Cooperative, has meanwhile published its financial statements.

Inalpi SpA, the intimidation of GIFT and Égalité

On 8/24/21 Inalpi SpA-with two PECs signed by its financial director Alessandro Daniele, to the addresses of the writer and Égalité Onlus-attempted to intimidate the respective organizations (see Attachments 1,2).

The Moretta (CN) industry complains about the ‘falsehood‘ of ‘allegations‘ that ‘are not supported by any evidence or proof‘ and complains about the ‘copy-paste‘ of data from its financial statements. He threatens legal action, intimates not to write any more and to ‘rectify‘ the articles, but without indicating the text of any rectification request.

The wish expressed by the writer – that the judiciary and supervisory authorities (CONSOB, Antitrust) would verify the correctness of Inalpi SpA’s operations and corporate communications – was itself misunderstood. Without any ‘innuendo,’ the writer did not in fact refer to any ongoing investigation. On the other hand, he called for the opening of investigations and even the appointment of a receiver to safeguard jobs and creditors whose fates are closely linked to those of In.Al.Pi. S.p.A.

Piedmont milk, the sign of responsibility

On 18.8.21 Piedmont Milk-in a letter addressed by its president Raffaele Morello to all members (see All. 3)-shared the outcome of the 28.7.21 meeting. The cooperative has participated in the Inalpi project since 2009. Its cooperators applied the supply chain protocol, submitting to the audits and related scores. In 2018, the cooperative introduced an internal reward mechanism, and in 2020, 50% of it was awarded to members.

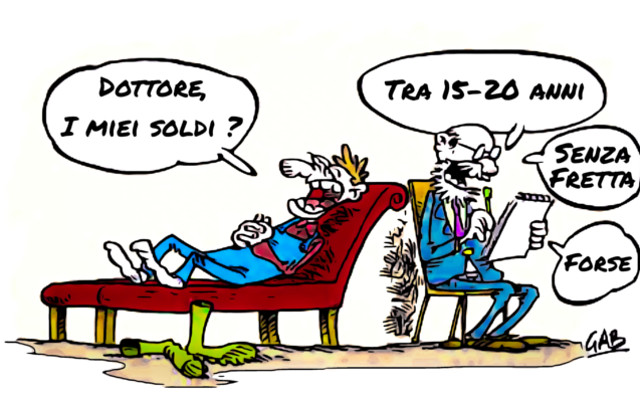

‘Now we have decided, albeit reluctantly, not to accept all the new commitments that the supply chain has required of us. In particular, our Assembly agreed with the Board’s proposal not to subscribe, like Piedmont Milk, to the bond regulation.

We have not seen fit to burden our members with such a commitment. Commitment that could see its completion in 15-20 years. (…)

It is clear that this decision will lead to an exclusion of Piedmont Milk from the Inalpi supply chain’

(All. 3).

Compral Latte, 5 million in 20-year IOUs

Instead, Compral Latte-whose meeting had convened on 7/16/21-followed up the bond ‘offer’ of Inalpi SpA, its only customer, by deciding to subscribe to 15-20 year risk capital worth €5 million. And Compral Latte director Bartolomeo Bovetti celebrated this operation-along with Coldiretti federal delegate Bruno Rivarossa-as ‘a case that will set a standard‘.

‘Behind it all is the occult puppet master, Bovetti, who not content with having fleeced the old APA, where he was director for 20 plus years, retired, so to speak, and was put in charge of Compral Latte, and then Compral Carne as well. Those who want to understand understand, the rest is just fiction‘, wrote Mr. Giuseppe Crosetti in a comment to the article where the news was reported, three weeks ago.

Compral Latte, 2020 budget

Compral Latte’s financial statements as of 12/31/20 were published in recent days. It is not easy to see the space for a 5 million euro venture capital ‘investment,’ let alone a 15-20 year payback perspective. Some insights to follow.

Compral Latte. Balance Sheet

Current assets

– Accounts receivable due within the next year, € 21.066 mln (+ € 5.607 mln compared to 2019)

– Cash and cash equivalents, total € 18 thousand (- €83 thousand compared to 2019)

– total assets € 23.937 million (+ € 5.951 mln)

Passive

– Due to banks, € 10.840 (+ € 3.586 mln over 2019)

– accounts payable, € 12.069 mln (+ €2.152 mln)

– total debts € 22.937 (+ € 5.714 mln)

– total liabilities € 23.937 (+ € 5.951 mln)

Compral Latte. Profit and loss account

– value of production, total € 67.584 million (+ € 7.367 over 2019)

– production costs, total € 67.289 mln (including € 63.316 mln of milk contribution from members. Total production costs were € 60.015 mln in 2019)

– Difference between volore and cost of production € 295,048 (+ € 83 thousand)

– profit for the year €230,354 (+ €68,512)

Compral Latte, notes to 2020 budget.

‘After the close of the fiscal year , there were no significant events to report,’ reads the notes to Compral Latte’s 2020 financial statements. Doesn’t the resolution 16.7.20 – to underwrite the convertible bonds of its only customer in the amount of € 5 million – have ‘relevance‘, in the accounts of a company with € 23 million in debts as of 31.12.20? (3) Does this explain the omissions on items 1-6-8-9 on the Agenda of the meeting minutes where this decision was made?

Without indulging in the fairness of corporate communications, Compral Latte, in order to finance Inalpi with almost no return, will have to borrow on far more unfavorable terms. (4) Of the two, either its director has lost sight of the abacus, or Inalpi has forced its milk supplier n. 1 to pay its own debts. And the seniority of Mr. Bonavetti, class of 1947, makes the former unlikely. (5) Future debt to posterity.

#CleanSpades.

Dario Dongo

Attachments

(1) Inalpi SpA, PEC 24.8.21 to Dario Dongo ANNEX 1

(2) Inalpi SpA, PEC 24.8.21 to Égalité Onlus ANNEX 2

(3) Piedmont Milk, letter 18.8.21 to members ANNEX 3

Notes

(1) Dario Dongo. Inalpi, Coldiretti and Compral Latte. #CleanSpades. GIFT (Great Italian Food Trade). 8/21/21, https://www.greatitalianfoodtrade.it/mercati/inalpi-coldiretti-e-compral-latte-vanghepulite

(2) Dario Dongo. Inalpi calls on milk suppliers to pay its debts. GIFT(Great Italian Food Trade). 7/19/21, https://www.greatitalianfoodtrade.it/mercati/inalpi-chiama-i-fornitori-di-latte-a-pagare-i-suoi-debiti

(3) Cf. OIC 29. Changes in accounting principles, changes in accounting estimates, correction of errors, events occurring after the end of the fiscal year. OIC (Organismo Italiano di Contabilità) Foundation. Text updated as of 12/29/17, https://www.fondazioneoic.eu/wp-content/uploads/2011/02/2017-12-OIC-29-Cambiamenti-di-principi-contabili….pdf

(4) Gross annual nominal fixed rate 2%. See the regulations of the Inalpi bond, in the article cited in footnote 1

(5) Compral Meat and Compral Milk: two cooperatives and a common home for 450 livestock farmers who together turnover more than 80 million. Ruminantia. 8.1.20, https://www.ruminantia.it/compral-carni-e-compral-latte-due-cooperative-e-una-casa-comune-per-450-allevatori-che-insieme-fatturano-oltre-80-milioni/

Dario Dongo, lawyer and journalist, PhD in international food law, founder of WIISE (FARE - GIFT - Food Times) and Égalité.